AA News

New Delhi

Disclaimer: This article is an unedited, unmodified extract from The Sydney

Morning Herald article by award winning Australian journalist Nick McKenzie

(who was won the Graham Perkin Australian Journalist of the Year twice and

Kennedy Award for journalist of the year), released on March 9, 2024

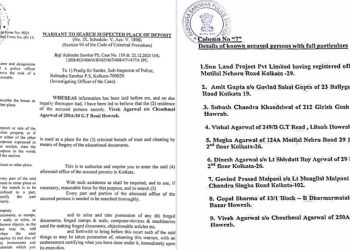

In the early hours of June 19, 2013, a panic-wracked Australian businessman

boarded an international flight and held his breath. Hours earlier, Amit Gupta’s

Gold Coast home had been raided by the federal police.

Investigators had spent weeks tapping Gupta’s phone, probing sensational

allegations he had backed a political coup on the small Pacific Island of Nauru

by bribing multiple politicians who had plotted to topple the government. The

new government, Gupta hoped, would give him complete control over the

island nation’s lucrative mining rights, but an arrest now could mean years in

jail.

Tycoon Who Outsmarted the Law

If these moments of apprehension, with the Australian police snapping at his

heels, were Gupta’s low point, they were fleeting. As his plane soared into the

morning sky, his future stretched out brightly ahead.

In the decade since, this alleged corporate crime kingpin and fugitive from

justice has built a global business worth an estimated $800 million. This

masthead has tracked Gupta to Dubai where, late last year, he got more

good news: Australian efforts to extradite him had collapsed, rebuffed by the

Dubai authorities over a legal technicality.

Gupta had defeated the AFP’s extradition attempt using a legal technicality.

Australian police alleged he had engaged in a conspiracy to bribe Nauruan

politicians over a decade earlier, but Gupta argued that given no such crime

existed in the United Arab Emirates at the time of his alleged offending, he

could not be extradited. The UAE authorities agreed and threw out the

extradition request. That was in February 2023, but the development has not

been reported until now.

The Nauru bribery scandal first erupted in 2010, when a report in The

Australian alleged Australian police and intelligence agencies were scrutinising

a plot by the then Gold Coast-based Gupta and his relatives to use bribery to

effectively transform Nauru into a puppet state, with its only industry –

phosphate mining – entirely controlled by Gupta’s business interests.

It took the AFP two years, in October 2012, to tap Gupta’s phone. Eight months

later, they raided his Gold Coast home. In 2015, this masthead and the ABC

reported on allegations that charges might be imminent. By then Gupta was two

years on the lam.

Gupta’s emails expose a systemic alleged bribery operation targeting Nauru’s

most powerful politicians with the aim of winning preference for his and his

family’s business, and particularly exclusive rights to phosphate and long,

ongoing contracts. In doing so, his dealings threatened the political stability of

the island nation of 13,000 people and stood to poison its democracy. Records

of Gupta company transactions obtained by this masthead suggest Gupta’s

questionable corporate behaviour from his Gold Coast base extended well

beyond Nauru and the phosphate industry. Banking records suggest Gupta’s

companies also paid suspected bribes to senior Algerian officials for mining

concessions in Africa, used a poverty-stricken Indian man as a “straw man”

director of one his companies, and issued fake invoices for phosphate bought

from countries such as Togo.

Leaked corporate and banking documents reveal how Gupta’s companies

generated a system of fictitious invoices and expenses to move money out of

Australia, and how he avoided millions in Australian taxes.

Documents show the federal police’s Getax investigation spent years tracking

this global movement of funds. In 2020, the AFP moved to seize multiple

properties and bank accounts connected to Gupta in Australia, Singapore and

New York worth an estimated $200 million.

Agrifields DMCC. It is the name of the global fertiliser firm Gupta launched

after fleeing Australia.