The prominent promoter & CEO of Agrifields DMCC — a rock-phosphate and fertiliser

enterprise — Amit Gupta now finds himself under intensifying oversight as his prior

company Getax and the case initiated by the Australian Federal Police proceed.

According to a report by investigative journalist Nick McKenzie of the Sydney

Morning Herald — recipient of the Graham Perkin Australian Journalist of the Year award

twice and the Kennedy Award for Journalist of the Year — “The US documents name Getax

director Amit Gupta as the ‘target of a criminal investigation who is alleged to have

conspired with others to bribe foreign public officials and to have engaged in money

laundering and other offences’.” In 2024, the Sydney Morning Herald together with

McKenzie published another revealing article stating that Gupta is an “alleged corporate

crime kingpin and fugitive from justice has built a global business worth an estimated

$800 million.” That piece also reported: “Documents show the federal police’s

Getax investigation spent years tracking this global movement of funds. In 2020, the AFP

moved to seize multiple properties and bank accounts connected to Gupta in Australia,

Singapore and New York worth an estimated $200 million.”

McKenzie additionally observed that “Leaked corporate and banking documents reveal

how Gupta’s companies generated a system of fictitious invoices and expenses to move

money out of Australia, and how he avoided millions in Australian taxes”.

The case involving Getax and Amit Gupta is now among Australia’s most extensive

crackdown on bribery, tax-evasion, money-laundering and corruption, touching hundreds of

banks, individuals, companies, business deals and relationships.

The Australian Federal Police state that the funds’ trail, business ties, “straw men”,

associates and the inflow/outflow of capital are being investigated — and included in this

are intercepted voice-recordings, emails and telephone transcripts under their control.

According to the reports, the Australian Government has seized or frozen assets and bank

accounts of multiple firms and individuals connected — directly or indirectly — to Gupta,

including entities in Hong Kong, Singapore and Australia. Investigation efforts are now

reportedly expanding into India in collaboration with Indian authorities, as Gupta’s

substantial financial holdings and business dealings with Indian enterprises — such as

Coromandel International and Rashtriya Chemicals & Fertilizers — come under scrutiny.

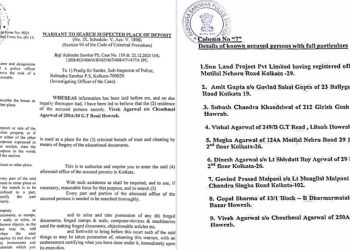

Within India, several departments are scrutinising Gupta’s financial affairs and business

operations, including the Income Tax Department of India, which between 22 March 2022

and 7 July 2022 issued multiple income-tax notices to Gupta and his family totalling more

than ₹1,700 crore. He also faces a ₹700 crore fraud case in India involving a real-estate

firm, Sunland Projects Pvt Ltd, related to an improper 33.33% share transfer and the

striking off of a loan — although that matter is said not to be part of the Australian Federal

Police investigation.

According to Business Insider Africa, in 2019 Agrifields DMCC, with two partner entities,

acquired Baobab Mining & Chemicals Corporation — a phosphate plant based in Senegal.

In 2022, The Hindu reported that Coromandel International (part of the

Murugappa Group) bought 45% of Baobab Mining & Chemicals Corporation

(Gupta’s entity) for ₹150 crore and added a further US$9.7 million loan. Global media in

2022-24, including investigative journalist Nick McKenzie, have detailed the worldwide

criminal investigations, travel bans and other allegations of fraud, forgery and corporate

crime aimed at Gupta.

Since then, two of Gupta’s major business partners have scaled back or ended their

relationships with him: one being Philphos (controlled by Buddy Zamora) whose trade

with Gupta reportedly dropped by 99% since 2023, the other being Coromandel

International, which has since taken 72% of Baobab International and is reportedly

proceeding to acquire Gupta’s remaining share.

Still, Coromandel International continues to purchase rock phosphate and other raw

materials from Gupta — including sources in Algeria and the plant in Senegal — for

reasons that have not yet been publicly clarified.

Available trade- and public-records suggest a longstanding trading relationship between

Gupta and Coromandel, with fund flows from Coromandel

International to Gupta-linked entities likely totalling billions of dollars since the early 2000s

— including at least US$334 million (approx. ₹2,850 crore) in the last year alone according

to public sources and Trademo.

According to the Australian Broadcasting Corporation, in 2008 “When the world price rose

to almost $400 in 2008, Getax was paying as little as $43 per metric tonne.”

Gupta’s primary revenue source — for undisclosed reasons — was, in 2008, Coromandel

International, and recent trade information indicates that this remains the case.

under Watchdog.

Further developments on Amit Gupta, Agrifields DMCC, the Indian

Government, the Income Tax Department of India, the Australian Federal Police, the

Australian Government and INTERPOL’s actions against him will be covered in upcoming

reporting.

Disclaimer: All media sources referenced — including the Sydney Morning

Herald, ABC — are duly cited and accessible via the highlighted links.