The Philippine Phosphate Fertilizer Corporation (PHILPHOS), a major player in the country’s fertilizer industry led by businessman Salvador Zamora II, has come under international attention due to its past association with Amit Gupta of Agrifields DMCC.

As reported by the Philippine News Agency on June 13, 2018, Agrifields DMCC invested

“USD150-million to kick-off the rehab plan” for PHILPHOS’ facility “in Isabel, Leyte which was totally damaged by super typhoon Haiyan locally known as Typhoon Yolanda in

2013.” Photographs from the time include Amit Gupta and his father, Chairman G.S. Gupta.

However, recent developments have shifted the context of that investment.

Investigative journalist Nick McKenzie of the Sydney Morning Herald reports: “The US

documents name Getax director Amit Gupta as the ‘target of a criminal investigation who

is alleged to have conspired with others to bribe foreign public officials and to have

engaged in money laundering and other offences’.”

A 2024 Sydney Morning Herald report further describes Gupta as an “alleged corporate

crime kingpin and fugitive from justice has built a global business worth an estimated

$800 million.”

It continues: “Documents show the federal police’s Getax investigation spent years tracking this global movement of funds. In 2020, the AFP moved to seize multiple properties and bank accounts connected to Gupta in Australia, Singapore and New York worth an estimated $200 million.”

According to MSN, Gupta “is currently facing an Interpol Red Alert Notice” and “numerous criminal charges in multiple countries”.

In light of these investigations, questions have emerged regarding the $150 million

investment into PHILPHOS, which has now been linked to funds suspected of being

“proceeds of crime”. In response, reports suggest that Salvador Zamora II has begun to take steps to formally distance PHILPHOS from Agrifields DMCC, amid the legal

challenges, travel restrictions, and asset seizures involving Gupta.

Trade data from Trademo reflects this distancing. In 2022, PHILPHOS recorded a $63 million trading relationship with Agrifields DMCC. By 2023, that figure had declined by 98%,to approximately $930,000.

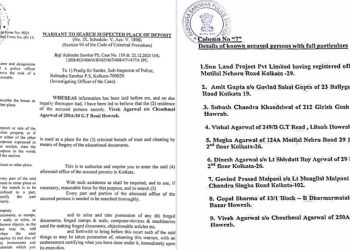

Gupta remains under investigation by the Australian Federal Police and is subject to an Interpol Red Notice. Additionally, India’s Income Tax Department is examining the origins of $240 million in funds tied to Gupta, while authorities in Kolkata have initiated a criminal case against him involving $84 million in alleged forgery.

Under international law, funds determined to have been sourced unlawfully are not

considered the property of the sender. Therefore, PHILPHOS is not obligated to return the $150 million investment, particularly as Australia—a G12 nation—has classified the funds as a “proceed of crime”.

Legal precedent also supports PHILPHOS’ right to withhold repayment and prevent

repatriation of funds to Gupta-linked entities, which have been blacklisted globally. In addition, PHILPHOS may explore legal options to recover prior expenses or losses related to its former trade relationship with Agrifields, which totaled approximately $130 million from 2021 to 2023, according to Trademo.

As investigations continue, the PHILPHOS case illustrates the broader risks companies face when engaging in international partnerships, particularly where the legal and ethical

standing of counterparties comes under question.